The discussion surrounding the U.S. government’s decision to acquire a 10% stake in Intel, as explored by Ben Thompson in his blog Stratechery, highlights a complex interplay of national security, market dynamics, and the semiconductor industry’s future. The investment, estimated at $8.9 billion, has sparked significant debate over its implications for both Intel and the broader technological landscape of the United States.

### A Shift in U.S. Industrial Policy

Thompson acknowledges the critical concern raised by critics such as Scott Lincicome, who outlines several downsides to government intervention in private enterprises. Critics argue that the government’s stake might skew Intel’s business decisions toward political motives, compromising their fiduciary duties, and create a ripple effect where other companies could feel compelled to favor Intel products, thus creating an unlevel playing field.

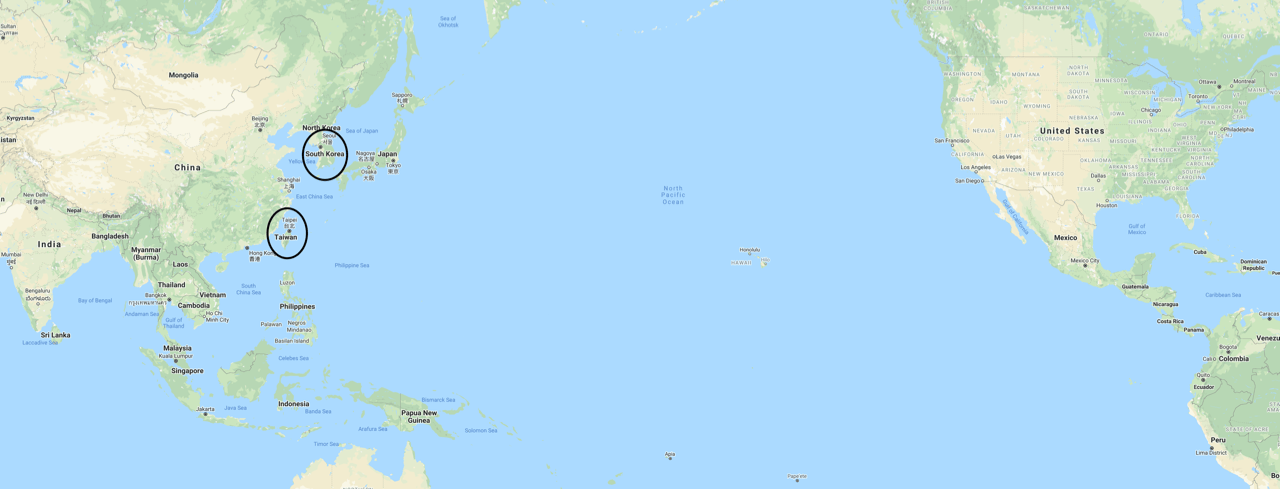

Despite these criticisms, it is essential to approach the situation with a steelmanning perspective, recognizing the root causes that have led to the U.S.’s involvement with Intel. The global semiconductor landscape, particularly concerning Taiwan and China, presents unique challenges; should tensions escalate, the U.S. could face severe supply chain disruptions for critical technologies, including military systems.

### The Geopolitical Landscape

The strategic importance of semiconductors cannot be overstated. Taiwan Semiconductor Manufacturing Company (TSMC), located in Taiwan which lies in proximity to China, plays a crucial role in chip production. Most high-performance chips essential to various sectors, including defense and artificial intelligence (AI), are manufactured here. For U.S. military planners, this geographic reality poses significant challenges.

The recent surge in AI’s reliance on advanced chip manufacturing exacerbates these vulnerabilities. Should conflict emerge, the U.S.’s dependence on Taiwanese manufacturing could severely compromise its technological advantages and national security. Thompson argues that the situation demands immediate attention, supporting the rationale for government equity in Intel to bolster national semiconductor production capabilities.

### Long-Term Implications

While critics like Lincicome suggest that Intel’s operational challenges stem from political oversight complicating decision-making processes, Thompson counters that the semiconductor industry requires long-term, stable investments. The decisions made today, especially regarding chip manufacturing, will reverberate for decades. The industry’s inherent nature is slow-moving, requiring extensive R&D and capital investment.

Intel’s struggles are partly due to strategic missteps made in the past, particularly missing opportunities in the mobile chip market. The resulting decline in its competitive position means that merely acquiring government funding may not be enough to turn the company around. It needs to reestablish its credibility as a foundry able to serve various external customers beyond its traditional focus.

### Competing in the Semiconductor Industry

In the face of fierce competition, particularly from TSMC, fully recovering from setbacks poses an enormous challenge for Intel. The argument isn’t merely about where chips are produced but extends to their reliability and performance. For companies like Nvidia and AMD, the choice to partner with Intel could be a gamble if Intel cannot assure consistent production quality.

Notably, Intel’s credibility issues compound its predicament. Thompson rightly notes that potential customers are hesitant to invest resources into Intel’s foundry capabilities without assurance that those capabilities will be stable in the long term. A government stake might help bridge this trust gap by providing a sense of security and longevity.

### The Role of Government

Thompson suggests that while the acquisition may draw valid criticism about the role of government in business, it might be a necessary intervention given the high stakes involved in semiconductor manufacturing and national security. He presents a nuanced view that, while the involvement of the government in private companies is generally fraught with issues, the current geopolitical environment makes this investment a potentially “least bad” option.

In this light, government involvement does not completely eliminate the risks associated with a monopolistic market—especially when another player like TSMC is an established giant. However, ensuring that U.S. semiconductor manufacturing capabilities remain competitive, particularly against such players, could provide the necessary impetus for Intel to innovate.

### Concluding Thoughts

Thompson’s assessment provides a balanced look at the hard truths facing the U.S. semiconductor strategy. The need for a reliable domestic supplier cannot be understated, especially given the geopolitical tensions surrounding technology supply chains. Although government intervention is rarely ideal, in this instance, it may serve as a stabilizing force that encourages Intel to refine its operations while safeguarding national security interests.

While no one can predict with certainty whether this stake in Intel will yield the desired outcomes, it undoubtedly marks a significant shift in how the U.S. approaches its critical industries. In the long run, the success of this initiative will heavily depend on Intel’s response to the changing market dynamics and its ability to rebuild trust with both consumers and partners in the semiconductor ecosystem.

Source link