Quantum computing stocks experienced a substantial surge on Thursday following a report from the Wall Street Journal indicating that the Trump administration was considering the acquisition of equity stakes in several quantum technology companies in exchange for federal funding. Companies such as IonQ (IONQ), Rigetti Computing (RGTI), D-Wave Systems (QBTS), and Quantum Computing (QUBT) were notably impacted, with stock prices soaring as investors reacted positively to the news.

Stock Price Movements

IonQ, recognized as the first pure-play quantum computing firm to go public, saw its stock price rise as much as 13% in morning trading following the report. Rigetti and D-Wave’s stocks jumped by approximately 16% and 22%, respectively, while Quantum Computing’s shares also rose by 13%. This significant uptick came amidst ongoing volatility in the quantum computing sector, which has been characterized by a mix of speculation and hope driven by broader federal interest in advanced technologies.

However, these gains were somewhat tempered later in the day as Yahoo Finance reported that the Commerce Department had stated it was not in negotiation for equity stakes with quantum computing firms. This clarification led shares to pare some of their earlier gains. Although the administration didn’t confirm ongoing discussions, the mere suggestion stirred market enthusiasm, reflecting the sensitive relationship between policy announcements and investor sentiment in high-tech fields.

Federal Funding for Quantum Computing

The proposed investments would involve a minimum of $10 million allocated to each selected company from the Chips Research and Development Office, part of the Commerce Department’s broader efforts to bolster U.S. competitiveness in advanced technologies. This aligns with a significant trend in which the U.S. government has shown increasing readiness to intervene in corporate matters, especially within the technology and defense sectors.

Historically, both the Trump and Biden administrations have recognized the strategic importance of quantum technology. The National Quantum Initiative Act, signed into law by Trump in 2018, committed $1.2 billion in federal funding towards quantum research. Under Biden, the CHIPS and Science Act further authorized substantial financial support for federal quantum computing initiatives. Notably, during Trump’s presidency, bipartisan support for quantum research led to a proposal for an additional $2.7 billion to enhance research into practical quantum solutions.

Insights into the Technology

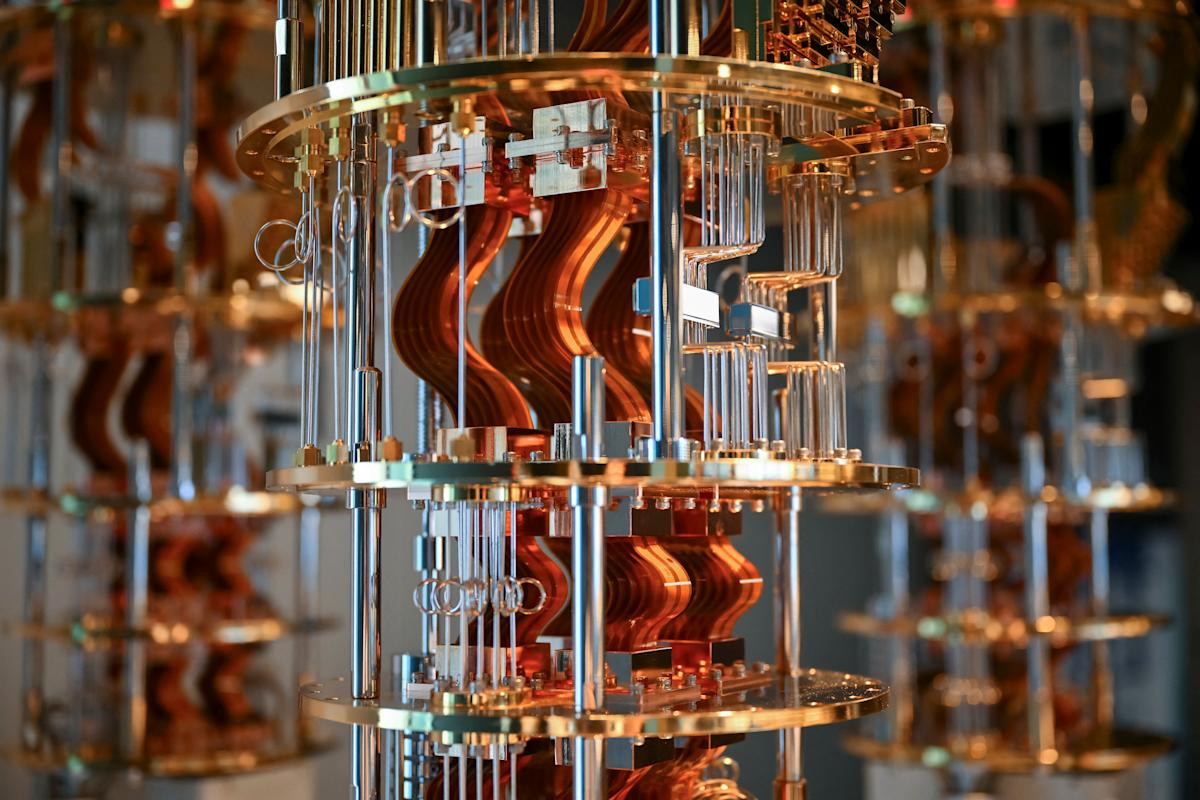

Quantum computing holds the promise of solving complex problems far beyond the capabilities of classical computing, offering the potential to revolutionize fields such as cryptography, materials science, and artificial intelligence. While the market for quantum computing is expected to explode—Bank of America projects it will grow from $300 million in 2024 to $4 billion by 2030—significant technical challenges remain. Quantum systems are highly sensitive and prone to error, complicating the journey toward seamless, practical applications.

Despite these challenges, major tech players including Google and IBM have made significant strides in the field, granting investors confidence in the growth potential of quantum technology. Reports of technological breakthroughs in quantum chips by these companies further fueled optimism in the market, leading to an increase in the stock prices of various quantum firms throughout the year.

Market Trends and Investor Sentiment

The price movements of quantum computing stocks have been marked by considerable fluctuation. Just weeks prior to the recent surge, stocks in firms like IonQ, Rigetti, D-Wave, and Quantum Computing faced notable declines. IonQ and Rigetti had dropped approximately 7% and 10%, respectively, with D-Wave down by 15% and Quantum Computing decreasing by 7% in a single day. Such volatility is indicative of how sensitive the market is to both news cycles related to government actions and the overall technological advancements being made in the industry.

Furthermore, JPMorgan’s recent announcement of a $1.5 trillion investment plan spread over a decade, aimed at industries vital to national security, including quantum computing, has been another significant driver of interest and investment. These movements underscore an increasing recognition of quantum technology’s crucial role in future economic and security landscapes.

Conclusion

While the initial excitement surrounding reports of government equity stakes in quantum computing firms has the potential to shift market dynamics, investors should approach such news with a degree of caution. The clarification from the Commerce Department serves as a reminder of the fluid nature of governmental involvement in private enterprise and the speculative landscape that often characterizes emerging technologies.

As quantum computing continues to evolve, it carries with it both risks and unprecedented opportunities. The growing investment interest from both the government and private sectors suggests a collective acknowledgment of the importance of advancing quantum capabilities. However, the pursuit of practical applications remains a priority as key players navigate the delicate balance between innovation, investment, and the challenges inherent to developing viable quantum technologies.

In the months and years to come, stakeholders should keep a close watch on both policy developments and technical advancements within the quantum computing space, as they will undoubtedly shape the investment landscape and determine which companies may emerge as leaders in this transformative field.