In recent analysis concerning the price trajectory of Ethereum (ETH), Mark Newton, the Global Head of Technical Strategy at Fundstrat Global Advisors, has speculated that ETH could reach as high as $5,500 by mid-October. With the current trading price around $4,506 as of September 16, the cryptocurrency has seen fluctuations, including a recent pullback, raising questions among traders and analysts alike.

### Current Market Conditions

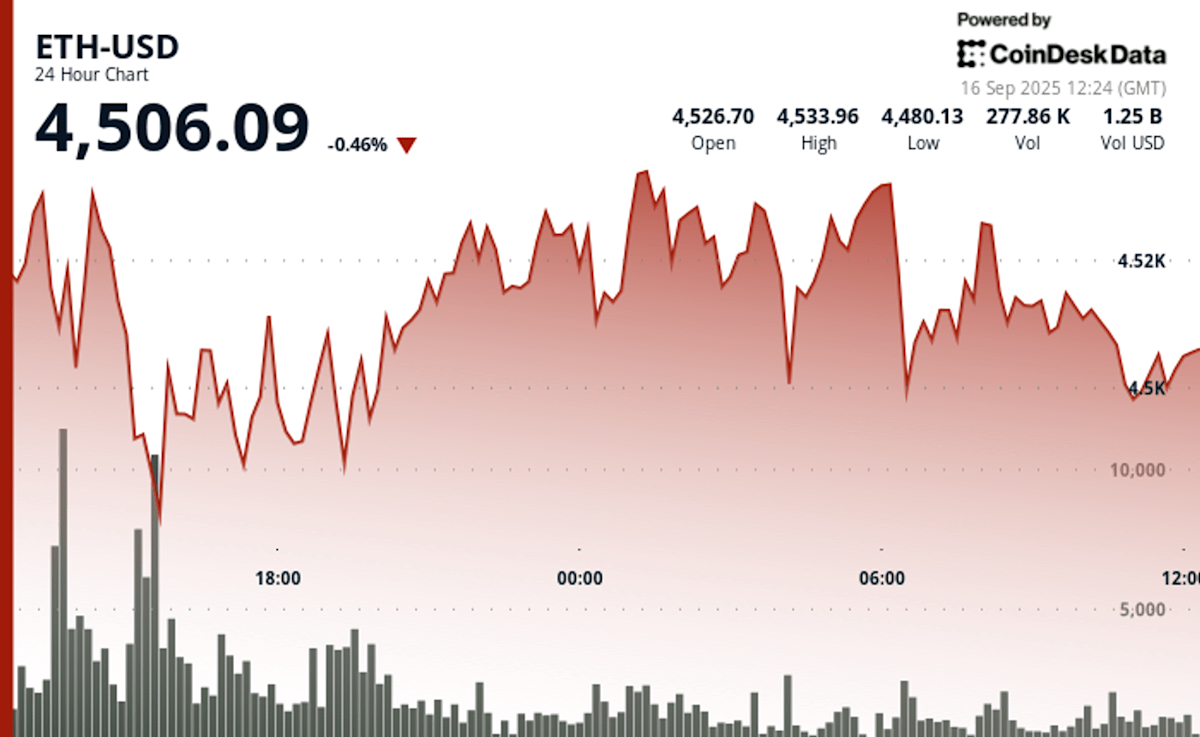

As per CoinDesk, ETH traded at $4,506, which represented a decrease of 0.5% over a 24-hour period. This slight decline has sparked discussions regarding its implications for the future of ETH’s price. An important point made by Newton is that although the market has been experiencing volatility, it is merely a correction that traders had anticipated following previous price surges. He emphasized that he does not foresee ETH dipping below its previous low of $4,233, indicating that potential dips to $4,418 or $4,375 next week should be viewed as buying opportunities.

### Recent Price Movements

In an analytical review of ETH’s performance, data shows that ether lost about 3% during the trading window on September 15. After experiencing a peak of $4,619, prices fell to approximately $4,500. This decline was notably sharp, especially between 07:00 and 08:00 UTC, when prices plummeted from $4,632 to $4,514. The surge in trading volume during this period, which exceeded the daily average, hints at active participation from both buyers and sellers but reflects heightened market uncertainty.

Following this drop, buyers stepped in to slow the momentum of the decline, and a short-term “floor” was established around $4,471. On the other end of the spectrum, the “ceiling” was capped at $4,671, creating a $200 range within which ETH has been trading. This fluctuation illustrates the ongoing battle between supply and demand dynamics, and how traders react to sudden price movements.

### Technical Analysis Insights

CoinDesk’s technical analysis indicates that after the initial sharp decline, ETH appears to be stabilizing. The data reveals that during the latest trading session, ETH hovered around $4,506 after showing signs of recovery. Prices ranged between $4,479 and $4,505, and buyer interest around $4,490 to $4,495 has provided a level of support, helping stabilize the market. However, the inability to break back above the $4,530 mark reflects ongoing selling pressure at higher levels.

### Future Projections and Market Sentiment

Newton’s projection of reaching $5,500 by mid-October hinges on the idea of a continued market strength, suggesting that investors should keep an eye on the potential of reaching new highs amidst existing corrections. His analysis implies a degree of confidence in Ethereum’s recovery and growth, backed by the technical patterns observed.

However, while bulls point towards potential climbs, market sentiment remains cautious. The fact that trading activity surged significantly during declines indicates investors are actively engaged, adding layers of complexity to the current market landscape.

### Conclusion

In conclusion, while Mark Newton’s assertion of a potential rise for ETH to $5,500 by mid-October is optimistic, the realities of the market must also be considered. As ETH currently stabilizes around $4,506, reaching new highs remains a complex interplay influenced by market sentiment, trading volumes, and external catalysts. Investors will need to stay attentive to emerging patterns and signals, as the journey forward for Ethereum will not lack volatility and uncertainty.

Continued analysis and awareness of upcoming market events will be crucial for those engaged in trading or investing in Ethereum. Whether this anticipated ascent materializes will depend on a myriad of factors, and only time will reveal the trajectory ETH will follow in the coming weeks.

Source link