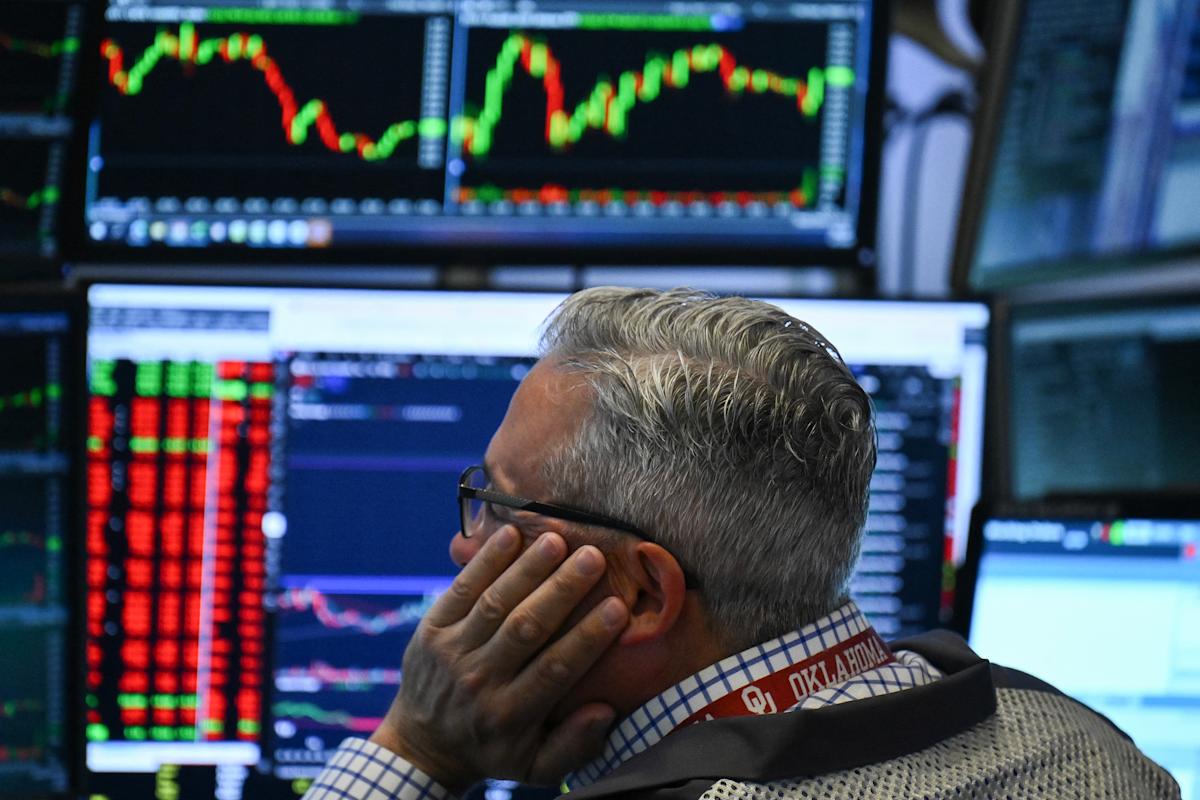

The recent announcement from the Federal Reserve has left financial markets in a state of volatility, as the Dow, S&P 500, and Nasdaq indices stall in response to the central bank’s decision to maintain current interest rates. The Fed had previously cut rates by 0.25% in December and has now held the benchmark rate steady at a range of 4.25%-4.5% for the fourth consecutive meeting. This decision aligns with the Fed’s forecasts projecting two rate cuts in 2025, which remain unchanged from their March outlook. However, the June meeting indicated a more divided opinion among Fed officials, suggesting varying perspectives on the future direction of monetary policy.

Following this meeting, the Fed released its Summary of Economic Projections (SEP), featuring the much-discussed “dot plot”—a graphical representation of policymakers’ expectations for future interest rates. Interestingly, this latest dot plot revealed that most officials anticipate a more cautious approach to rate cuts than before. While the Fed’s projections highlight a reduction of the fed funds rate to around 3.9% this year, there are indications of an internal divergence, with some FOMC members suggesting no rate changes for the remainder of the year.

### Economic Impact and Market Reactions

Markets had entered this decision day with speculation surrounding the possibility of one or two additional rate cuts in 2025. The central bank’s latest projections show that while twelve officials anticipate a cut this year, there is an increase in the number of those who expect no change to occur. Specifically, seven FOMC members have positioned themselves as more hawkish compared to March, where only four officials maintained this stance. Such contrasting opinions within the Fed could further contribute to market uncertainty.

With inflation projections revised upward, combined with an increase in expected unemployment figures, the economic outlook appears more cautious than before. This dual update is particularly concerning for investors, signaling that while there may be plans for future cuts, the overall economic landscape is demanding greater scrutiny. The Fed has trimmed economic growth forecasts, a move that could lead to more skeptical consumer and investor behavior as they navigate these uncertain waters.

### Projections for Inflation and Unemployment

The Federal Reserve has adjusted its inflation and unemployment projections through the end of this year, which significantly impacts market sentiment. Typically, rising inflation expectations suggest potential hikes in interest rates, leading to a more cautious approach among investors. The latest forecasts indicate a nuanced understanding of economic dynamics, highlighting the balancing act the Fed must maintain between stimulating growth and controlling inflation.

The central bank’s decision to hold rates steady reflects a broader strategy of caution as officials weigh the potential risks associated with economic growth. With FOMC members more divided on future rate cuts, market participants are left in a state of anticipation, pondering how these changes may affect borrowing costs moving forward.

### FOMC Members’ Perspectives

The internal perspectives among FOMC members are particularly telling in their differing opinions on rate cuts for the coming year. While there are indications that some officials predict just one interest rate cut for the remainder of the year, the division within the Fed underscores the challenges that lie ahead. With the rise of seven hawkish members opposing any rate cuts this year, caution is key in the Fed’s approach to reassess their strategy concerning interest rates.

This level of internal division reflects the complexity of aligning monetary policy with the current economic climate. As conditions continue to evolve, the Fed must remain vigilant. This ongoing discourse among policymakers adds an extra layer of uncertainty that could shape investor decisions moving forward.

### Monitoring Economic Indicators

Going forward, the path laid by the Fed will be increasingly monitored by analysts and investors alike. Key economic indicators such as inflation, unemployment, and GDP growth will be critical in shaping expectations surrounding interest rate adjustments. As these metrics fluctuate, the Fed’s responses will likely reflect a more reactive approach, aiming to maintain the balance necessary for sustainable economic growth.

Investors are urged to stay abreast of economic data releases and Fed communications, as these will provide vital insights into the timing and rationale behind future rate adjustments. The forthcoming months will be crucial in determining how the Fed navigates the complex dynamics of inflation and economic growth, influencing both short-term and long-term market movements.

### Conclusion

In summary, the Federal Reserve’s decision to hold interest rates steady is a pivotal moment for the markets. With predictions of two rate cuts in 2025 still intact, the division among policymakers has sparked considerable speculation regarding the future of monetary policy. As inflation and unemployment forecasts shift, the Fed finds itself at a critical juncture, tasked with maintaining economic stability against a backdrop of uncertainty.

The impacts of this decision extend beyond mere numbers, showcasing the intricate interplay of policy decisions, market reactions, and economic indicators. Looking ahead, investors must prepare for a landscape marked by caution and unpredictability, remaining resilient as they navigate the complexities of the current economic environment. As always, focus on key economic indicators will be essential for anticipating the Fed’s next moves and understanding the broader implications for financial markets.

Source link