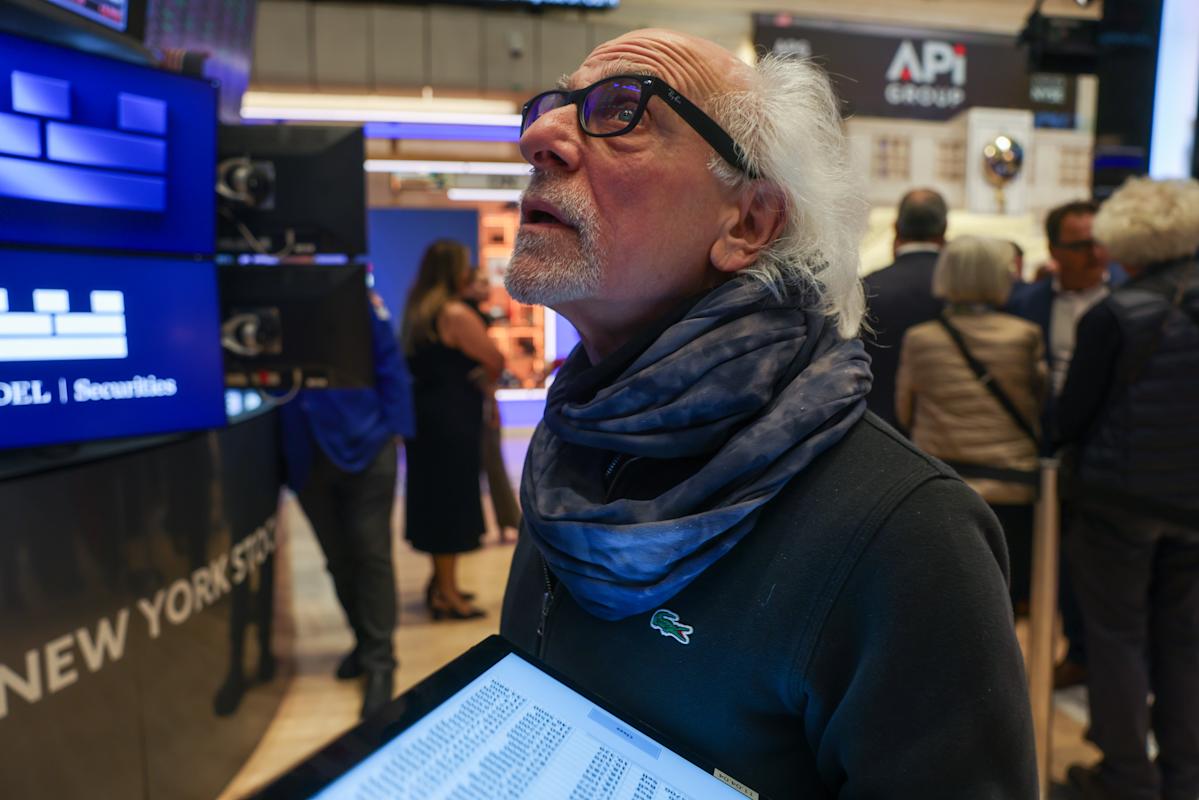

US stock futures rallied on Thursday after a significant court ruling blocked many of President Trump’s tariffs, sending the Dow Jones, S&P 500, and Nasdaq futures sharply higher. The Dow Jones Industrial Average futures rose by 1.2%, while S&P 500 futures jumped by 1.5%. The tech-heavy Nasdaq 100 led the charge, soaring by 1.8%. This uptick comes in response to a panel of judges at the US Court of International Trade’s decision to deem the tariffs imposed under emergency powers as illegal. The ruling, however, remains open to appeal by the Trump administration in federal court.

This development could have far-reaching implications not just for US-China trade relations, but also for investors who have been grappling with the uncertainties brought on by fluctuating tariffs. The optimism from the ruling coincided with Nvidia’s latest earnings report, which resonated positively in the market despite some cautionary notes regarding export restrictions. Nvidia, a leader in AI chip technology, managed to beat revenue expectations, though it fell short on adjusted earnings per share due to the US government’s ban on the sale of its H20 chips to China. The company warned that it anticipates missing out on $8 billion in sales over the next quarter because of these restrictions.

Despite these challenges, Nvidia shares exhibited a notable bounce in after-hours trading, indicating Wall Street’s approval of the company’s overall performance and outlook. In his remarks during the earnings call, CEO Jensen Huang voiced strong criticisms of the US government’s chip export curbs, suggesting they may inadvertently encourage innovation among competitors in China. “China’s AI moves on with or without US chips,” he stated, underscoring the urgency for the US to maintain a robust foothold in this pivotal market.

The robust earnings report from Nvidia has bolstered sentiment on Wall Street that major tech companies can endure the implications of President Trump’s broader trade policies. Investors are now looking ahead to earnings reports from retail giants like Best Buy and Costco, who are facing the scrutiny of balancing profit margins with the pricing pressure created by tariffs. Retailers are particularly vulnerable, as seen in Walmart’s previous financial disclosures where the company was pressured to absorb cost hikes associated with new duties imposed by the Trump administration.

As we look toward upcoming economic data, including weekly jobless claims and revisions to the first-quarter US GDP, analysts will be keeping a keen eye on how the markets will react to these indicators. The initial GDP release indicated a contraction for the first time in three years, raising questions about the health of the US economy going forward.

Moreover, amid the mixed responses to various earnings reports, Wall Street appears to be cautiously optimistic overall. Goldman Sachs analysts noted that while the court ruling on tariffs provides a short-term boost to markets, there are still long-term implications that investors need to consider. The tariffs’ initial intent—protecting US industries—may still resurface in various forms, potentially creating volatility in the market.

While the market celebrates the immediate rally, companies like HP Inc. saw a different fate as they grappled with the economic headwinds created by ongoing tariff disputes and a weakening economy. HP experienced an 8% drop in pre-market trading after cutting its profit outlook, citing pressures from both the tariffs and a slowing market demand.

As investors navigate this complex landscape of tariffs, trade, and earnings, it is crucial to remain vigilant and adaptable. The interplay between economic policy, corporate performance, and market reactions is more interconnected than ever, making it critical for investors to stay informed about both the immediate consequences and the long-term repercussions of these developments.

In conclusion, the recent court ruling to block several of President Trump’s tariffs has injected a wave of optimism into the market, allowing key indices to rebound. Nvidia’s earnings further confirmed that the tech sector might withstand the ongoing trade tumult, although caution remains prudent given the evolving economic indicators. As we await further earnings releases and economic data, the landscape remains dynamic, underscoring the necessity for investors to remain engaged with the pulse of the market.

Source link