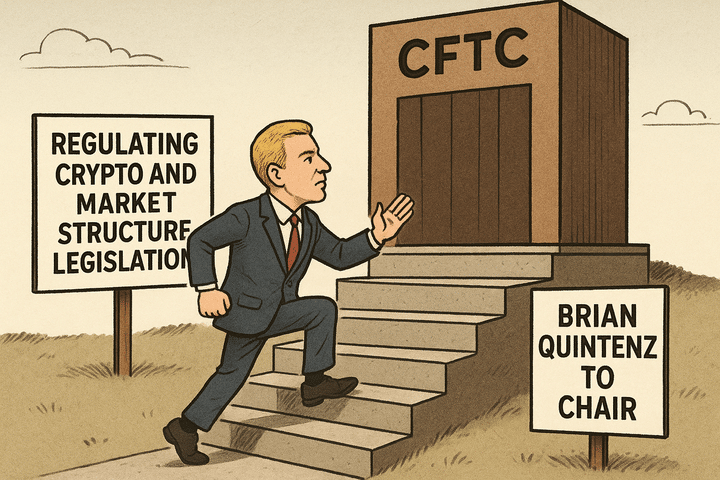

The cryptocurrency industry is currently facing significant uncertainty stemming from the delayed confirmation of Brian Quintenz as the Chair of the Commodity Futures Trading Commission (CFTC). His nomination, which has been put on hold due to lobbying by notable figures like Cameron and Tyler Winklevoss—the founders of Gemini—could have ripple effects on the long-debated Clarity Act, aimed at establishing a regulatory framework for digital assets in the United States.

Uncertainty Amid Regulatory Landscape

As the crypto sector grapples with a valuation surpassing $4 trillion, the ongoing regulatory turmoil presents a crucial challenge. Quintenz’s expected leadership position is vital not just for guiding the CFTC but also for clarifying the oversight roles between the CFTC and the Securities and Exchange Commission (SEC). The Clarity Act, which has garnered bipartisan support, seeks to resolve these regulatory ambiguities by designating the CFTC as the principal regulator for non-security digital asset commodities such as Bitcoin and Ethereum.

The stakes are particularly high as Congressional negotiations on the Clarity Act are underway, with political maneuvering heightening the urgency for a confirmed CFTC Chair. Chris Perkins, president of CoinFund, highlighted the impracticality of regulating such a vast industry without adequate leadership: “How does a market structure bill work if… there’s nobody home?” This reflects a broader sentiment among industry leaders who contend that a well-staffed CFTC is critical for effective governance within the crypto market.

Implications of Quintenz’s Delayed Confirmation

Quintenz has been caught in a web of political dynamics, with his nomination stalled primarily due to a request from the Winklevoss twins, who have had previous disagreements with him on regulatory matters. Despite industry support for Quintenz—a letter from seven D.C. crypto associations was sent to President Trump urging for his swift confirmation—the White House has begun exploring alternative candidates, aggravating concerns among crypto stakeholders about the future trajectory of crypto legislation.

With the hope that the Clarity Act will introduce much-needed clarity and stability to the market, any delay in Quintenz’s confirmation not only hampers regulatory progress but could also lead to a lack of direction for the CFTC in the immediate aftermath of the Act’s potential passage. Industry insiders warn of dire consequences should the agency operate without a permanent leadership team. The risk exists that even if the Clarity Act is enacted, inadequate oversight could destabilize the entire sector.

Challenges Within the Legislative Framework

The political landscape surrounding the Clarity Act is complex. While the appointment of Quintenz only needs a simple majority in the Senate, passing the Clarity Act requires a more challenging 60 votes. This has resulted in Democrats leveraging their negotiating power, particularly due to the absence of confirmed Democratic commissioners within the CFTC. Historically, it is customary for presidents to nominate candidates from both major political parties to maintain balance among commissioners, a practice that has not been adhered to under the current administration.

The implications of this political stalemate could extend beyond the immediate future of regulatory clarity. For instance, failure to advance the Clarity Act could push its prospects further into the future, complicated by the pending midterm elections, which can make passing significant legislation even more daunting.

The Stakes for the Crypto Industry

While the Trump administration has expressed the ambition of positioning the United States as a global leader in the cryptocurrency space, the ongoing leadership vacuum at the CFTC jeopardizes this objective. Industry experts underscore the urgency of prompt leadership at the CFTC to manage emerging complexities in the crypto landscape. Without a confirmed Chair, the CFTC will face significant challenges in staffing, regulatory planning, and adapting to new market dynamics.

As Perkins pointed out, strong leadership is imperative not only for fulfilling the U.S. commitment to crypto regulation but also for ensuring that the burgeoning digital asset market can thrive without unnecessary hindrances. “If this market isn’t fixed, institutions will stay on the sidelines,” he stated, indicating that regulatory clarity can facilitate broader participation by institutional investors.

The Path Forward

The situation at hand raises multiple questions about the future landscape of cryptocurrency regulation in the U.S. Should the various stakeholders—regulatory bodies, legislative leaders, and the crypto industry itself—fail to come together, the prospects for the Clarity Act may recede, further complicating the overarching strategy for managing digital assets.

Moreover, even amidst attempts to bring about coordinated oversight within the CFTC and SEC, there remains considerable anxiety regarding the preparedness of the CFTC for the expanding responsibilities associated with regulating a complex and evolving market. The CFTC has been ill-equipped in the past to handle this new territory, and if leadership structures remain unstable, crypto regulation may continue to lag behind the industry’s rapid evolution.

In conclusion, the expansiveness of the cryptocurrency market requires a clear and effective regulatory framework. The prolonged delay in Quintenz’s confirmation not only jeopardizes the progress of the Clarity Act but also threatens the overarching goal of establishing the United States as a leader in the global crypto ecosystem. For meaningful progress, stakeholders must prioritize the establishment of reliable leadership at the CFTC, ensuring the agency is prepared to meet the demands of a diverse and growing market landscape. The crypto industry, while robust, thrives best in an environment of clarity and stability—both of which hinge on decisive regulatory action in the near future.