In the ever-evolving world of cryptocurrencies, Bitcoin and Ethereum continue to dominate discussions among investors contemplating their next move. These two cryptocurrencies account for an impressive 70% of the total crypto market, making them the most prominent players in the space. So, should you opt for Bitcoin or Ethereum? Let’s break down the strengths, potentials, and market dynamics associated with these two titans.

### Market Overview

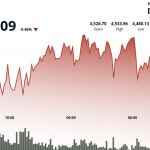

As of recent reports, Bitcoin (BTC) is trading at approximately $117,000, with predictions suggesting it could reach $1 million by 2030—a potential tenfold increase in value. Meanwhile, Ethereum (ETH), which has seen a remarkable 37% increase year-to-date, is currently priced at around $4,500, with forecasts indicating it might hit $7,500 by the end of 2023 and potentially $25,000 by the close of 2028.

### Upside Potential

When analyzing upside potential, it’s vital to recognize Bitcoin’s position as “digital gold.” This analogy stems from Bitcoin’s resilience to various geopolitical and economic shocks. Historical data shows that Bitcoin tends to bounce back efficiently from market turmoil. For example, during the early stages of the COVID-19 pandemic, while Bitcoin initially fell, it eventually posted a 24% return over the next two months, far outpacing gold’s 2% return during the same period.

On the other hand, Ethereum’s recent performance has garnered significant attention, particularly due to its pivotal role in the burgeoning decentralized finance (DeFi) market. With strong backing and rapid innovation, Ethereum is becoming a leader in decentralized applications (dApps), with its blockchain underpinning a multitude of stablecoins and DeFi projects. Notably, the introduction of dedicated treasury companies investing heavily in Ethereum has also boosted its value, creating a steady demand that could further elevate its price trajectory.

### Hedge against Macroeconomic Risks

Despite Ethereum’s enthusiastic growth prospects, Bitcoin retains a strong reputation as a hedge against macroeconomic risks such as inflation. Its limited supply—capped at 21 million coins—positions it favorably compared to fiat currencies, which can be printed in unlimited quantities. BlackRock’s analysis of Bitcoin highlights its strength during economic downturns, setting it apart as a go-to asset for investors looking to safeguard their portfolios from inflationary pressures.

### Long-term Viability

Both Bitcoin and Ethereum have shown resilience, but they cater to different aspects of the investment spectrum. Bitcoin is viewed as a store of value and a hedge against unpredictable economic climates. In contrast, Ethereum is seen as a platform for innovation, and its vast use cases position it well within the growing demand for blockchain solutions, particularly in finance.

### Which is the Better Buy?

When weighing the merits of Bitcoin and Ethereum, one must consider individual investment goals. For those seeking immediate gains and a stake in the evolving technological landscape, Ethereum’s potential continue to lure in price-sensitive investors. However, for risk-averse individuals looking for stability amidst market chaos, Bitcoin remains the safer bet.

Although Ethereum’s short-term gains are impressive, Bitcoin’s long-term potential, in terms of both price appreciation and its utility as a hedge, seems compelling. In 2025, Bitcoin might lag behind Ethereum in terms of annual gains percentage, yet its stability in adverse conditions establishes a case for its reliability as an investment option.

### Portfolio Strategy

For investors considering a significant allocation towards either cryptocurrency, performing due diligence is paramount. Allocating funds toward a mix of both Bitcoin and Ethereum could balance immediate growth potential with long-term viability and risk tolerance.

If a hypothetical investor were to consider investing $1,000 today, they might contemplate diversifying that amount between the two assets based on their investment strategy. For example, investing $600 in Bitcoin and $400 in Ethereum could provide exposure to both security and growth.

### Conclusion

Ultimately, determining whether Bitcoin or Ethereum is the better buy depends on your investment strategy and market outlook. Bitcoin offers a tried-and-true method of preserving value, particularly in tumultuous times. Conversely, Ethereum presents exciting opportunities tied to technological advances that could reshape the finance landscape.

As with any investment, volatility is inevitable in the cryptocurrency sphere. Therefore, understanding both assets’ characteristics, their potential upsides, and the macroeconomic factors at play will actively inform your decision. Whether you decide to buy Bitcoin, Ethereum, or split your investment between the two, thorough research and vigilance in monitoring market trends are essential. The world of crypto is dynamic, and being informed ensures you position yourself strategically for whatever comes next.

Source link