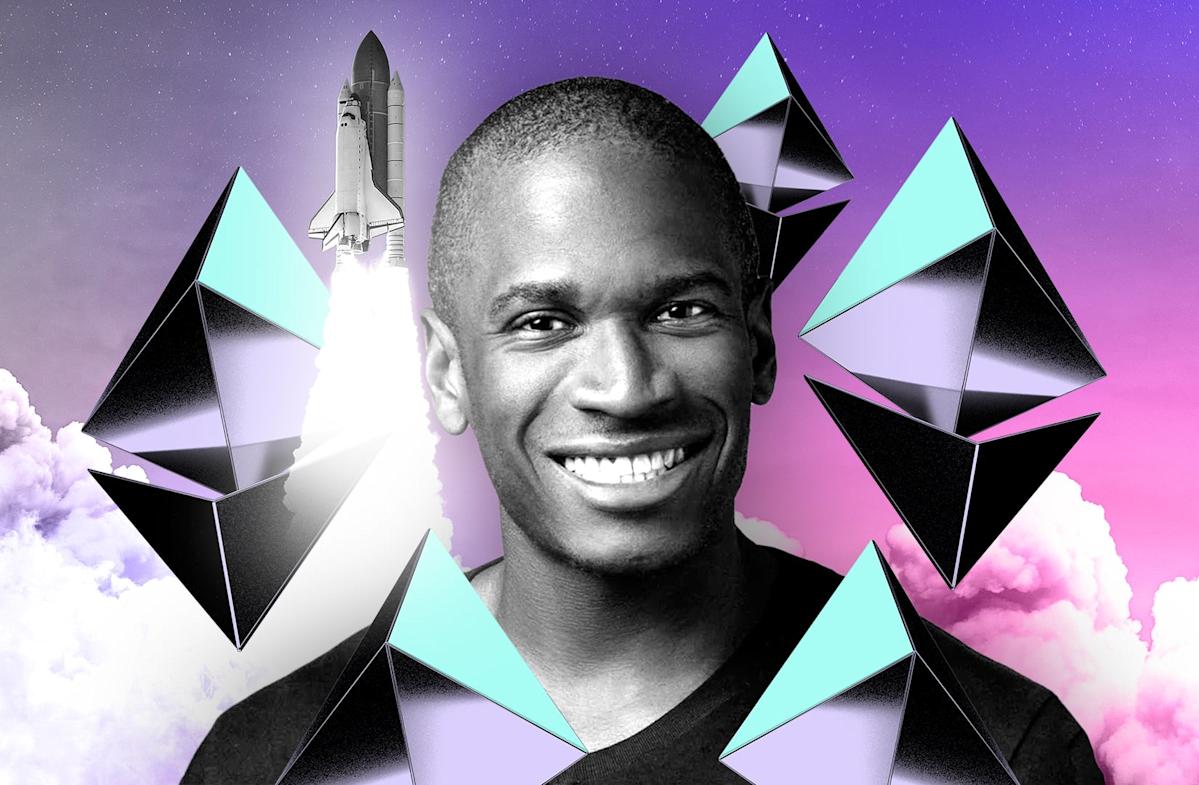

In recent discussions surrounding Ethereum, prominent cryptocurrency figure Arthur Hayes, the Chief Investment Officer at Maelstrom, has made incredible predictions regarding the asset’s future price. Notably, in a recent interview on Crypto Banter, Hayes stated that he believes Ethereum could surge to between $10,000 and $20,000 before the end of its current cycle. This speculation comes amidst a favorable environment following comments made by Federal Reserve Chair Jerome Powell, which hinted at a possible interest rate cut—a move that has historically influenced cryptocurrency prices positively.

Current Landscape of Ethereum

As of now, Ethereum has shown remarkable resilience and growth. In the wake of Powell’s address at Jackson Hole, the cryptocurrency jumped by 8%, trading at approximately $4,630. Analysts, including Hayes, are optimistic, suggesting that Ethereum’s upward momentum may not only continue but could potentially accelerate significantly. Hayes reiterated his stock-market-oriented belief, stating, “The chart says it’s going higher, you can’t fight the market.” His confidence marks him as one of the more robust advocates for Ethereum’s potential rise.

Despite its impressive gains, Ethereum is still below its all-time high of $4,878, achieved in late 2021. However, it has outperformed Bitcoin and other significant cryptocurrencies like Solana and XRP in the past two months. The notable gains, close to doubling its price in just a single quarter, have led to a broad consensus among some analysts that Ethereum is well-poised for further growth.

Price Predictions and Institutional Demand

Geoffrey Kendrick, head of digital assets at Standard Chartered, corroborates Hayes’s bullish outlook. Kendrick has forecasted Ethereum could reach up to $7,500 by the end of 2023, with an ambitious prediction of $25,000 by 2028. These predictions come amid a significant institutional demand surge for Ethereum, particularly through spot exchange-traded funds (ETFs). In August 2023, Ethereum ETFs witnessed net inflows approaching $3 billion, eclipsing the $562 million amassed by Bitcoin ETFs—a clear indicator of growing institutional interest.

Institutional acquisition of Ethereum has shown a steady increase among publicly traded companies. Data from CoinGecko indicates that organizations have increased their Ethereum holdings by more than 4% over a recent 24-hour period, establishing a firm grip on about 2.3% of Ethereum’s total supply. This trend underscores the growing acceptance of Ethereum as a valuable asset among institutional investors.

Market Dynamics Post-Powell’s Remarks

The broader cryptocurrency market has not been without its challenges. Recently, there has been noticeable volatility, with significant outflows recorded from both Ethereum and Bitcoin ETFs. However, the landscape shifted dramatically following Powell’s remarks. The anticipation of interest rate cuts generally creates a more risk-appetizing environment for investors, which often leads to inflows into speculative assets like cryptocurrencies.

Hayes’s assertions that Ethereum may increase to anywhere from $10,000 to $20,000 before the end of the cycle could eventually depend on broader economic conditions and market sentiment. Still, the fundamental driving forces highlight ongoing technological advancements in Ethereum, growing institutional interest, and an expanded user base, positioning the asset favorably amid fluctuating market conditions.

Key Factors Influencing Ethereum’s Future Valuation

Several key factors could influence Ethereum’s trajectory in the coming months and years:

Technological Advancement: Ethereum continues to evolve, with ongoing upgrades to its network, enhancing scalability, security, and sustainability. These improvements foster a more enticing environment for developers and businesses, further solidifying Ethereum’s utility.

Regulatory Developments: Regulatory scrutiny remains a pivotal issue for the cryptocurrency sector. Any favorable regulatory environment, particularly for ETFs and digital assets, could bolster institutional participation and subsequently drive price appreciation.

Market Sentiment: The cryptocurrency market is heavily influenced by investor sentiment, which can shift rapidly. Positive news, like Powell’s hints at interest rate cuts, may create favorable buying conditions. Conversely, negative developments could equally lead to a swift downturn.

Economic Factors: Broader macroeconomic trends, such as inflation rates and investor behavior amid shifting interest rates, significantly impact cryptocurrency valuations. As interest rates fluctuate, investors may search for assets to hedge against inflation, increasing their allocation to cryptocurrencies like Ethereum.

- Institutional Involvement: Continued interest and investment from institutional players could catalyze significant upward movements in Ethereum’s value. As more corporations incorporate Ethereum into their balance sheets, it can instill further confidence in retail investors.

Conclusion

Arthur Hayes’s bold prediction that Ethereum might reach between $10,000 and $20,000 before this cycle concludes reflects a broader optimism surrounding the cryptocurrency’s future. Key indicators—recent price movements, institutional demand, and shifting market dynamics—support this positive outlook. However, investors should tread carefully, recognizing the inherent volatility and risk associated with cryptocurrency investments.

Overall, as Ethereum continues to gain traction among institutional investors and experiences robust growth in the retail sector, it could very well pave the way for a new era in which it not only reclaims its previous all-time highs but also sets sights on unprecedented levels. The next months will be crucial in determining whether Hayes’s predictions bear fruit, and while the landscape remains uncertain, the combination of pivotal factors suggests a bright future ahead for Ethereum.